Understanding the Role of PCB Boards in the Growth of the Global Electronics Market

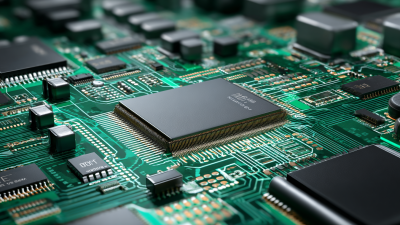

The global electronics market has witnessed unprecedented growth, with the PCB board industry playing a pivotal role in this expansion. According to a report by IBISWorld, the global printed circuit board manufacturing market is projected to reach $82 billion by 2023, driven by the increasing demand for electronic devices across various sectors, including automotive, telecommunications, and consumer electronics. PCB boards, essential for interconnecting electronic components, serve as the backbone of modern gadgets and technologies. The shift towards miniaturization and the proliferation of IoT devices further escalate the need for advanced PCB solutions, highlighting their significance in supporting innovations and enhancing the performance of electronic products. As the electronics market evolves, understanding the multifaceted role of PCB boards is crucial for stakeholders aiming to capitalize on emerging opportunities and navigate industry challenges effectively.

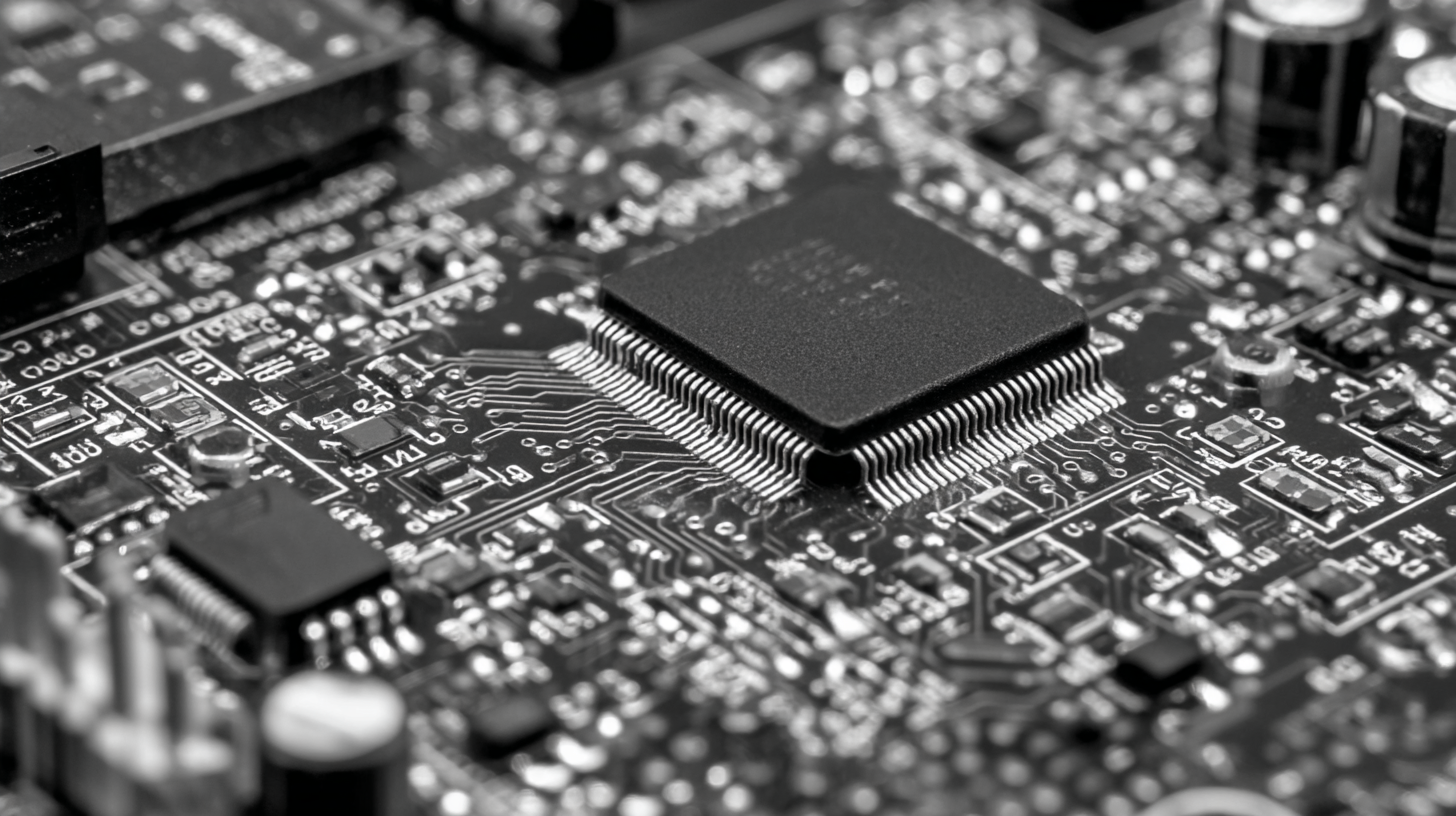

The Evolution of PCB Technology and Its Impact on Electronics

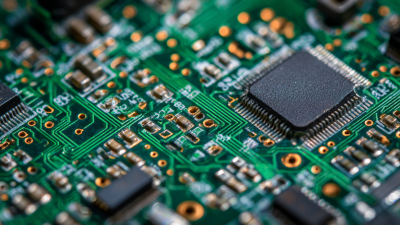

The evolution of PCB (Printed Circuit Board) technology has significantly influenced the electronics industry, driving innovation and enhancing performance across a wide range of applications. Initially, PCBs were simple connections, primarily used in rudimentary electronic devices. However, as the demand for more complex functionalities surged, PCB technology advanced to incorporate multilayer designs, flexible circuits, and high-density interconnects. These advancements have enabled the miniaturization of electronic components, allowing devices to become smaller and more powerful.

Moreover, the impact of PCB technology extends beyond mere size and capacity; it has been pivotal in fostering the development of new electronic products and systems. From smartphones and computers to advanced medical devices and automotive electronics, the improved thermal management and high reliability of modern PCBs have made it possible to achieve unprecedented levels of efficiency and performance. As industries continue to adapt to evolving consumer needs and technological advancements, the role of PCB technology in facilitating innovation remains crucial, further propelling the growth of the global electronics market.

Growth of the Global Electronics Market and PCB Technology Evolution

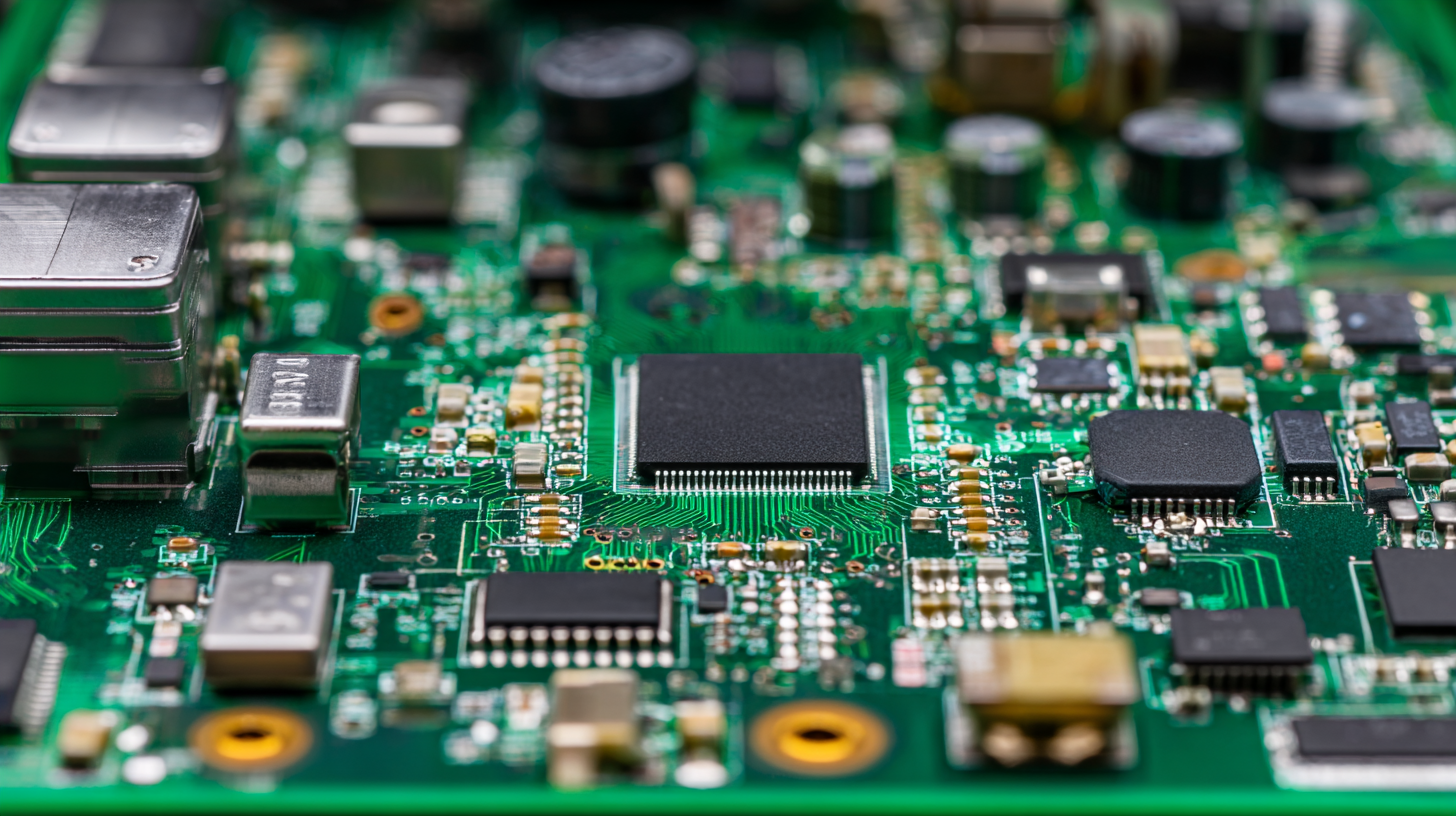

Key Functions of PCB Boards in Modern Electronic Devices

Printed Circuit Boards (PCBs) play a crucial role in the modern electronics landscape, acting as the backbone for a wide array of electronic devices. With rapid advancements in technology, the demand for compact and efficient PCBs has surged, leading to innovative designs and materials that cater to specific applications. From integrated circuits to hard disk drives, PCBs are essential for electrical connections and functionality, enabling devices to become smaller and more powerful. This miniaturization trend has led to a significant shift in the electronics market, driving growth in sectors such as telecommunications, healthcare, and consumer electronics.

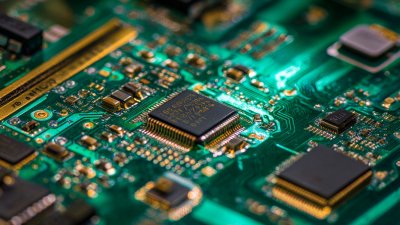

As the global electronics market expands, the unique properties of PCBs—such as thermal management and electrical conductivity—become increasingly vital. The rise of sophisticated applications, including wearables and flexible displays, has also underscored the importance of specialized PCBs that can cater to intricate designs. Countries like Thailand are capitalizing on this growth, emerging as major PCB manufacturing hubs in ASEAN, demonstrating the global shift towards enhancing PCB production capabilities. With projections estimating the market size for PCBs to reach approximately $41.2 billion in 2024, the industry is poised for continued development, driven by technological innovation and increasing consumer demand.

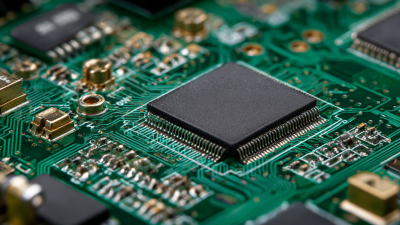

Market Demand: How PCB Advancements Fuel Global Electronics Growth

The demand for printed circuit boards (PCBs) has surged in tandem with the rapid advancements within the global electronics market. As technology evolves, the complexity and functionality of electronic devices require more sophisticated PCB designs that are capable of supporting higher performance levels. Innovations such as multilayer PCBs and flexible circuits enable manufacturers to create compact, efficient devices that maximize space and improve overall performance, directly responding to consumer demands for smaller and more powerful gadgets.

Moreover, the rise of emerging technologies such as the Internet of Things (IoT), artificial intelligence (AI), and wearable devices has generated an increasing need for specialized PCBs. These advancements necessitate enhanced connectivity and processing capabilities, which only modern PCBs can provide. The ongoing investment in research and development within the PCB sector is crucial, as it drives the creation of high-frequency, high-speed boards that cater to evolving market needs. Thus, the continual progression in PCB technology not only supports but propels the growth of the global electronics industry, enabling manufacturers to meet the growing expectations of consumers worldwide.

Challenges Facing the PCB Industry and Solutions Ahead

The PCB industry faces a significant challenge amidst the rapid adoption of AI technologies, which has intensified the demand for high-end PCB production capabilities. As AI applications proliferate, the integration of advanced PCBs becomes crucial to support the complex requirements of sophisticated hardware, particularly in data centers and high-performance computing environments. The relationship between AI growth and PCB manufacturing is clear: every chip relies heavily on printed circuit boards, making it imperative for manufacturers to elevate their production standards to meet the evolving technological landscape.

Furthermore, trade tensions between major economies add another layer of uncertainty for the PCB market. As companies strive to boost their high-end PCB capacities and navigate these geopolitical challenges, innovation and digital transformation are key to maintaining competitiveness. Initiatives focused on enhancing production efficiency and adopting cutting-edge design solutions are essential for PCB manufacturers aiming to capture opportunities in this AI-driven era while mitigating risks associated with fluctuating market dynamics.

Future Trends in PCB Manufacturing and Their Economic Implications

The future trends in PCB manufacturing are significantly intertwined with the evolving dynamics of the global electronics market and the broader economic landscape. One of the foremost implications is the shift in foreign direct investment (FDI), which is now increasingly focused on countries that demonstrate readiness for high-tech manufacturing and supply chain resilience. According to recent findings from the McKinsey Global Institute, an influx of announced FDI projects is reshaping the traditional manufacturing hubs, particularly emphasizing Southeast Asia as a potential growth center. This shift not only highlights the need for advanced PCB technology in new markets but also signals a restructuring of global supply chains that could influence electronic production costs.

Furthermore, the impact of geopolitical tensions and tariffs, particularly from the recent U.S.-China trade war, has forced many electronics companies to reconsider their manufacturing strategies. As companies face rising costs and uncertainties due to tariffs, investing in innovative PCB solutions becomes pivotal for maintaining competitive pricing and product reliability. Industry reports forecast that the PCB market will grow significantly, with an annual growth rate exceeding 4% through the next decade, driven by advancements in materials and manufacturing techniques. This growth could lead to enhanced economic activities in regions prioritizing PCB production, ultimately influencing the broader electronics economy.

Understanding the Role of PCB Boards in the Growth of the Global Electronics Market - Future Trends in PCB Manufacturing and Their Economic Implications

| Year | Global PCB Market Size (Billion USD) | Growth Rate (%) | Key Trends | Economic Implications |

|---|---|---|---|---|

| 2020 | 60 | 3.4 | Increase in IoT devices | Increased demand for consumer electronics |

| 2021 | 62 | 3.3 | Rise of electric vehicles | Growth in automotive electronics |

| 2022 | 65 | 4.8 | Adoption of 5G technology | Transformation of communication sectors |

| 2023 | 68 | 4.6 | Miniaturization of devices | Sustainability investments |

| 2024 | 70 | 2.9 | Growth in medical devices | Increased investment in healthcare |

Related Posts

-

How to Choose the Best PCB Board for Your Electronic Projects

-

Navigating Import Export Certifications for the Best Circuit Board Procurement Strategies

-

Navigating the 2025 PCB Design and Assembly Trends for Global Buyers

-

Challenges with Achieving Best PCB Printing Quality

-

Best PCB Electronics: A Comprehensive Comparison of Top Choices for Your Projects

-

Exploring Innovative Alternatives in PCB Design and Assembly for Global Buyers

MSIRobot